School System – GST Settings

After some tough decisions about data sharing and branch structure last week, this week we’ll be looking at even more pre-implentation decisions. While many of them are changeable later it’s good to review them early in the process as they may affect some of the calculations, what fields and even what screens you will see.

Tax (GST/VAT) Settings

GST stands for Goods and Services Tax and it’s a tax added on top of your prices. It’s very similar to the VAT (value added tax) – in fact so similar that the system settings are the same. Different countries have, of course, different GST rates – some have just one rate applicable across the board, some have different rates for different products, in some you do the return quarterly in others monthly. Regardless of that the principle is always the same. In my examples below, I am using GST as charged in Singapore and also all the references are to IRAS Singapore. In Singapore, the current GST rate is 7% and it’s charged across the board – with the exception of zero rated supplies and exempt services – none of which are really applicable to most of the schools.

The GST settings are quite simple. Of course, if you are not GST registered you can skip ahead to the next section. If you are, there are just three decisions to be made.

- whether to calculate GST per item or per document (the difference – if any – is just a few cents)

- if your prices already include the GST or the GST is added on top of invoice amount

- decide if you charge GST on deposits or not

Let’s see how each of them will affect the final price.

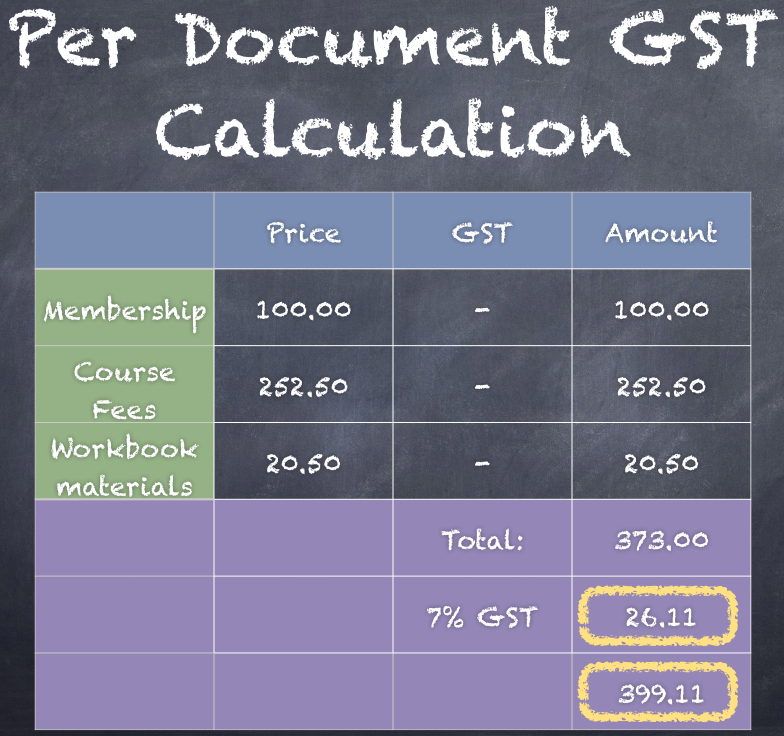

Per Item vs Per Document

The difference here is just in order of the steps. Per item setting will add GST for each invoice item first and separately and only then make total whereas per document setting will total up the invoice amount first and add GST only at the end.

As you can see, the difference is not much – just 1 cent. It’s because I tried to use round numbers (like 20.50 – not 20.55 and 525.50 – not 252.67, etc.). Still – that’s 1 cent on one sale. If you do a hundred sales per day, this can generate quite a difference in a couple of weeks. Of course, the difference will not always be increasing as some of the rounding will result in a few cents more (like here) and others will result in a few cents less. Still, the difference will be enough to cause a lot of issues if your accountant doesn’t use the same calculation method.

Bottom line is – always check with your accountant (or accounting software) which calculation method they use and set the system to follow the same. Also, you will need to do this for each of your centres/branches as it’s very common for some of them to either use a different calculation method or to not be GST registered at all. If you plan to use the AP module as well, you will need to set the correct settings for each of your suppliers (under CRM module). Otherwise, you may not be able to reconcile their invoices/bills with the system.

GST Included in Price vs Added on Top

When you walk into a supermarket, the price that you see on the price tags is what you will pay. In other words, the price already includes all the taxes. It’s also called a net price.

On the other hand, most of the restaurants’ menus will have prices without the taxes and (in some countries) without the service charge. So if you total up the price based on the menu, it will be less than what you will end up paying. To get the final price, you need to add the GST as well as the service charge.

While you are required to display the net prices (see here for details from IRAS), your back-end system can maintain the prices either way.

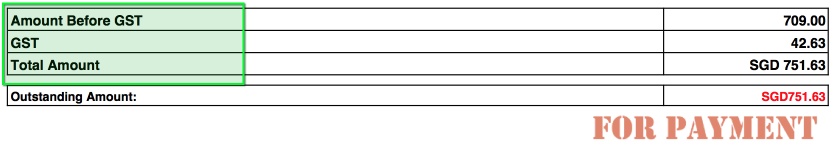

The previous section (per item vs per document) shows the calculations if your GST is not included in price – i.e. the restaurant model.

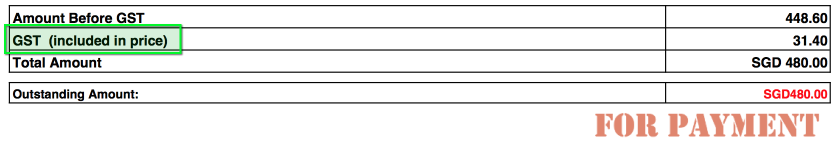

How to calculate the GST if it’s already included in your prices (i.e. the supermarket model)?

The GST is always calculated as your price PLUS the GST rate. So if the GST rate is 7% it will be your price (i.e. 100%) + 7%. This will make the final amount 100% + 7% = 107%. Hopefully, this is not too mathematical.

So if your price is $100.00 + 7% = $107.00. $7 being the GST and $100 being your revenue.

In other words, the $107 is the net price inclusive of GST. Since $107.00 is $100.00 x 1.07 (a.k.a 107%) then to work backwards and get our price from the net price we will have to divide the final price by 1.07:

$107.00 / 1.07 = $100.00

or if the net price is $100.00:

$100.00 / 1.07 = $93.46

So if the net price is $100.00, it consists of $93.46 of our revenue and $100 – $93.46 = $6.54 of GST.

It’s a very simple calculation, so why do I spend so much time on it? Because, as simple as it is it is not the most intuitive solution. Most of the people will simple multiply the net price by 7% and then subtract the net price from the result:

$100.00 x 7% = $7.00 of GST and the revenue part as $100.00 – $7.00 = $93.00.

This may seem logical – since the GST rate is 7%, however, it’s wrong because your base is different. If only I had a dollar for every conversation I had about this calculation :-)

How do we show this in the receipt?

Deposit – to GST or not to GST?

Lastly, a slightly contentious point of deposits. Should you charge the GST on deposit or not? You can read some explanation here. The IRAS says, depending on what your deposit represents you will either charge the GST or not. To give away the ending – the system supports both – you can either charge the GST or not – it’s your choice.

Our preference – and indeed preference of 99% of our customers is not to charge GST on deposits – but if your practice or preference is different, you can simply continue charging the GST.

If this is a sufficient explanation or you simply don’t care why…you can stop reading here. If you want or need the long story, then read on…

The issue here is with the word deposit having several meanings. It can either be a refundable deposit, a.k.a. a security deposit that is returned once the student properly withdraws. Or it can be a partial payment i.e. the full amount student needs to pay $1000.00 and he pays $500.00 now and $500.00 later – the first $500.00 sometimes being called a deposit because until you make a full payment the sale is not final.

The deposit, as understood by the system – and whenever I am talking about the deposit – falls clearly in the first category. To differentiate, we call the second category a ‘partial payment’ or a ‘split payment’ – both signifying that it’s in fact a payment for some existing or future sale.

So if the student withdraws in orderly manner meeting all the conditions for return of the deposit, the GST is not chargeable. Almost verbatim from the IRAS website.

Of course, we can never know that upfront. The deposit is a ‘security’ deposit – kind of an insurance in case the student doesn’t withdraw meeting the criteria for refund. In this case the deposit will be used to pay for some parts of the services – again almost verbatim from the IRAS website – unfortunately for the case where the GST should be charged. What now? If we didn’t charge the GST when receiving the deposit, can it be now used to offset the services or it MUST be refunded and the student must make a fresh payment for the amount owed?

Again, it was more than once that I heard the above argument. So which is it? Are all the deposits GST chargeable – since you are never really sure what they will be used for? In which case, why would IRAS even bother to include the option of a non chargeable deposit and what would be the purpose of the deposit that you are legally bound to refund in full regardless of the situation?

As a compromise the system allows both – you can make the deposit GST-able or you can exclude it from the GST calculation. It’s a simple switch. In reality, it doesn’t really matter. To either refund the deposit OR to offset any outstanding balance, the system will generate a credit note for the value of the deposit.

If the GST was charged when receiving the deposit, the same GST will now be on the credit note. If it was not, it won’t be on the credit note either.

Why is that? If you make a sale and then the sale is canceled, you will need to refund the customer including the GST he paid during the original sale. This GST amount will then reduce the amount of your output GST tax (i.e. it will be returned to you by IRAS in the form of deduction). More info is here.

So if the deposit was $100.00. If you charged GST you would have collected $107.00, however $7.00 would go to IRAS so you would keep $100.00. When either returning the deposit or using it to offset outstanding amount the credit note will have to generated for $107.00 -> $7.00 GST coming from IRAS (in the form of deduction) + $100.00 that you had kept.

If you don’t charge the GST than the you keep the original $100.00 and there is no transaction with IRAS. During the refund or offset the credit note will be generated for $100.00. The net effect for both is the same.

Now let’s say you use this credit note to pay off any existing debt the student may have with you. What about the GST? The GST has already been charged on the sale(s) (a.k.a invoice(s)) that created this debt. E.g. the student owes you $214.00 for his last invoice. Since your invoice already includes the GST you can just offset the deposit value from this amount and there are no further GST consequences.

Lastly, in the first scenario you will offset $107.00 and in the other $100.00 – so they are clearly different…aren’t they? Yes, but in the first case the student paid $107.00 and in the second only $100.00 – that’s where the difference is coming from.